Custom Private Equity Asset Managers - The Facts

Wiki Article

The Custom Private Equity Asset Managers PDFs

With its substantial market knowledge, the exclusive equity team partners with the monitoring group to improve, maximize, and scale the organization. Keep in mind, a lot of the financiers in the personal equity groups have been operators, or at the very least have actually functioned together with drivers, in the pertinent industry, so they can capably assist administration with the effective implementation of key initiatives within business.

The alternative of selling to personal equity groups definitely includes looking for the best cost, yet it also involves weighing long-term benefits. Keep in mind, there is the gain from the first sale, however likewise the proceeds from the ultimate sale of the rollover capitalist's remaining equity. With exclusive equity customers, your service can check out financially rewarding possibilities it might not or else have accessibility to.

Another development possibility that exclusive equity teams may pursue is growth through buy-side M&A, meaning discerning and very calculated add-on purchases. Syndicated Private Equity Opportunities. The best objective of personal equity groups (and of marketing to personal equity teams) is to broaden and expand the firm's productively, and one way to do that is through add-on acquisitions

In order to see this advantage, if add-on procurements are anticipated, make sure to assess the personal equity team's experience and success in getting these types of add-ons, including the successful subsequent integration (or not) of those purchases into the original service. In the ideal circumstances, there are clear advantages to offering to a personal equity group.

Custom Private Equity Asset Managers Can Be Fun For Everyone

That will not necessarily be the purchaser who uses the greatest sale price for the company today. Keep in mind, there are two sales to take into consideration: the first sale to the personal equity group and the future sale when the exclusive equity team sells its and the rollover capitalists' staying stake in business at a future exit.

We aid sellers identify personal equity investors with experience and links that pertain to your business, and we can help make certain that the financiers and your management team are aligned in their vision for future growth for business - https://peatix.com/user/20144170/view. If you want to investigate this site discuss the idea of offering to a private equity team, connect to us

You'll be close to the action as your firm makes bargains and gets and markets firms. Your associates will certainly be well enlightened and creative, and each PE project gives a various set of difficulties that you need to overcome. It's difficult to land an entry-level task unless you went to a top-tier college or have connected experience in the hedge fund or investment banking industries.

Even one of the most seasoned Wall surface Road driver will police to wishing to spend more time with his/her family members eventually. Women hold only 11. 7 percent of senior-level placements in exclusive equity firms as of March 15, 2015, according to Preqin (an alternate investment research firm)a portion that's considerably reduced than their depiction in the total U.S.

Excitement About Custom Private Equity Asset Managers

Like any various other organization, an exclusive equity firm's primary objective is to make cash, and they do that by acquiring individual businesses and marketing those services in the future for more cash than the original acquisition cost. A streamlined method to think about this is the "earnings" of a personal equity firm is the venture value of a company when they offer it, and the "expenses of items offered" is the enterprise worth of the company when they acquire it.

Possession monitoring costs are typically around 2% of possessions under monitoring (Private Equity Platform Investment). A $500 million fund would earn $10 million in these fees per year. https://www.viki.com/users/cpequityamtx/about. Efficiency costs, or lugged passion, generally typical around 20% of revenues from investments after a certain baseline rate of return is satisfied for restricted partners and even higher profits when higher return hurdles are achieved

These meetings can assist companies enhance by gaining from others facing comparable obstacles out there. Otherwise currently in place, personal equity firms will certainly look for to establish a board of directors for the business. Leveraging industry and service connections, they are able to recruit board participants that have substantial insight into locations such as the business's end markets and consumers that can aid enhance the company going onward.

The 2-Minute Rule for Custom Private Equity Asset Managers

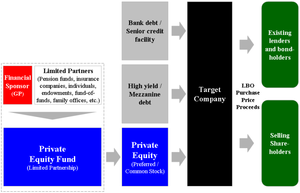

In Area 3 we take the point of view of an outside financier investing in a fund sponsored by the personal equity firm. Interpretations of exclusive equity differ, yet below we consist of the whole possession class of equity investments that are not priced quote on securities market. Personal equity stretches from equity capital (VC)working with early-stage firms that might be without revenues yet that possess great ideas or technologyto development equity, supplying funding to expand established exclusive organizations commonly by taking a minority passion, right to large acquistions (leveraged buyouts, or LBOs), in which the private equity company gets the entire firm.

Yet buyout transactions generally include private firms and extremely often a certain division of an existing firm. Some leave out venture resources from the personal equity cosmos due to the greater risk account of backing new firms instead of fully grown ones. For this reading, we refer simply to financial backing and acquistions as the two major forms of exclusive equity.

Growth Growth resources Financing to established and fully grown companies for equity, frequently a minority risk, to increase into brand-new markets and/or boost operations Buyout Acquisition resources Funding in the type of debt, equity, or quasi-equity offered to a firm to get one more firm Leveraged acquistion Financing offered by an LBO company to get a company Administration acquistion Funding provided to the administration to obtain a firm, specific product, or division (carve-out) Unique situations Mezzanine finance Funding usually offered in the type of subordinated financial debt and an equity twist (warrants, equity, and so on) frequently in the context of LBO purchases Distressed/turnaround Financing of business looking for restructuring or dealing with economic distress Single possibilities Funding in regard to transforming industry trends and new government regulations Other Other forms of private equity financing are additionally possiblefor instance, protestor investing, funds of funds, and secondaries. - Asset Management Group in Texas

Report this wiki page